Highlights

An estimated $1 trillion worth of assets will be transferred to the next generation of family owned companies in the Middle East over the next decade;

Most family-owned private businesses in the Middle East do not survive the second or third generation due to lack of business succession plans;

Business owners remain aloof or unconcerned to protect their assets and wealth while busy running businesses;

Proper business succession plans could ensure the protection of personal wealth and corporate assets under challenging circumstances.

Lack of proper business succession could cost an estimated US$1 trillion worth of business assets in the Middle East in the next ten years, according to the Gulf Family Business Council. If business owners do not take this seriously, their successors might not be able to acquire their hard-earned wealth.

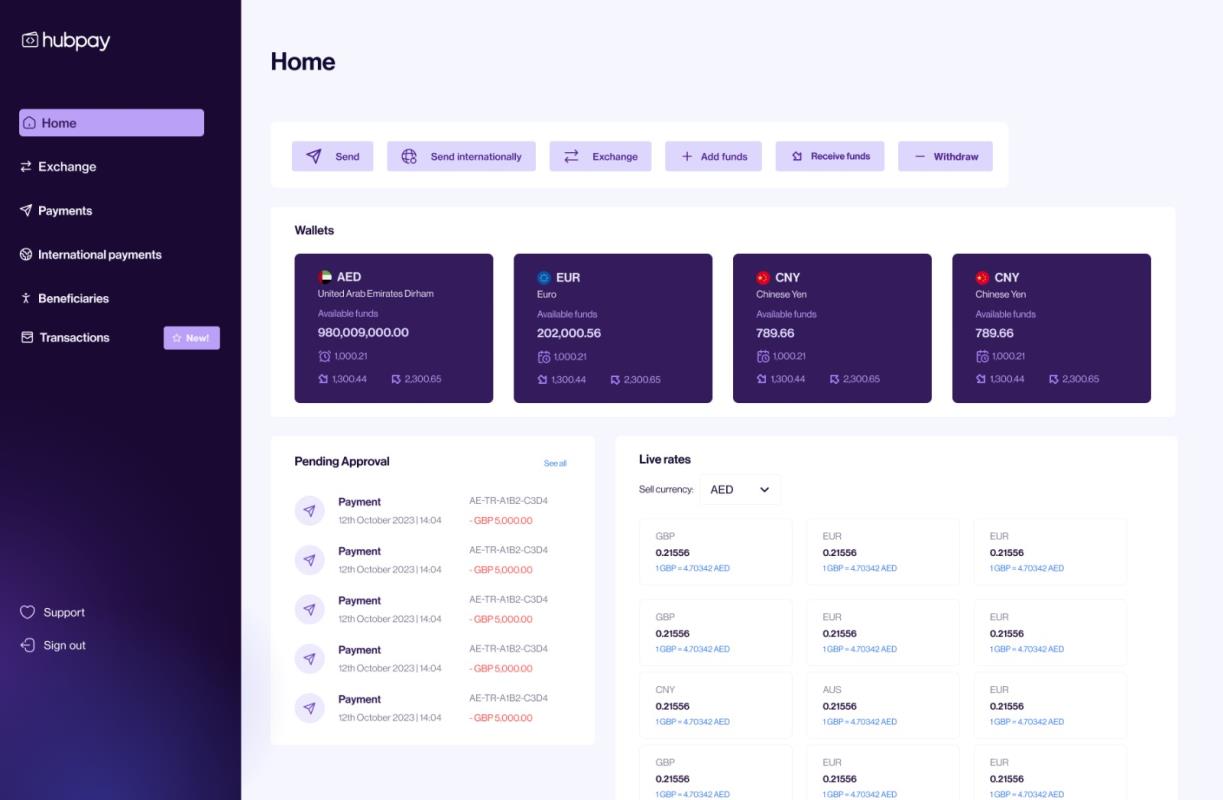

Business succession planning has now become more crucial with the new Ultimate Beneficiary Owner (UBO) regulation (UAE Cabinet Decision No. (58) of 2020 Regulating Beneficial Owner Procedures) that requires companies to declare the ultimate beneficiary of business transactions, shareholder and voting information. The regulation, which came into effect on October 27 this year, seeks greater transparency on the real beneficiaries of the businesses.

A UBO is the person or entity that is the ultimate beneficiary when an institution initiates a transaction. A UBO of a legal entity is a person who: holds an interest of minimum 25 percent capital of the legal entity, and/or holds minimum 25 percent voting rights at the general meeting of shareholders.

“A business owner spends all his life developing business, generating assets and wealth. However, he doesn’t do anything to protect the wealth and the interests of his family, successors. This is normal among most business owners.

“However, it is important for the business owner to ensure that his/her successors gain access and control of his assets and shares in the businesses, or a fair value of the shares if they want to exit the business. Without proper protection plans or policies, they usually do not get their fair share and in most cases, remains at the mercy of the existing shareholders.”

Succession plan, wealth management and estate planning is largely absent in Small and Medium Enterprises (SMEs) as well as family businesses.

“A critical scenario that needs to be carefully managed is when a shareholder decides to exit the family business and sell his equity stake. Proactively managing that process is essential for assuring long-term family business continuity, harmonious family relations, and shareholder ownership responsibility.”

Many family businesses in the Middle East have ceased to exist after the demise of their founders due to succession and legal issues owing to succession. Legal successors of the founder of businesses have seen their father’s assets changing hands depriving them from their dues.

A carefully planned shareholder protection plan could help ensure that on the death of a partner, a lump sum amount will be available to the remaining shareholders enabling them to buy back the share from the deceased’s family, remain in control and ensure the continuation of the business.

Leena Parwani, who started her financial services practice in 2013, has been one of the UAE’s top financial consultants for the last seven consecutive years, serving large corporations, entrepreneurs and business leaders.